|

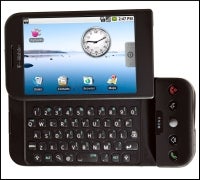

One could almost hear the gasps from handset makers and wireless carriers when T-Mobile announced yesterday that its Google G1 smartphone will cost $179.99 with a two-year subscription plan when it’s made available late in October.

Without a data contract, the G1 will retail for $399, according to the carrier, the U.S. unit of Deutsche Telekom.

Given the low price for the phone, few could blame AT&T (NYSE: T), Verizon Wireless or Sprint (NYSE: S) for taking a deep breath. After all, the launch comes as the industry is still feeling the effects of a pricing war that has seen device and plan costs slashed in a bid to gain market share in the competitive, and lucrative, wireless data environment.

The thinking, industry watchers said, is that the lower device cost could woo more subscribers to T-Mobile’s service. Two G1 data plans will be available for subscribers: Paying $25 each month gets users unlimited Web, e-mail, Google Talk instant messaging, 400 text or picture messages and access to T-Mobile’s Wi-Fi hot spots. For $10 more, a user can add unlimited messaging and use of additional IM clients. Each require a voice plan, which ranges from $39 to $100 — for unlimited usage — per month.

Spokespeople from T-Mobile declined to comment beyond providing details of the G1’s expected pricing and plans. AT&T, Verizon Wireless and Sprint also declined to comment, citing that plan rate and device pricing strategies are competitive market elements they don’t publicly discuss.

The G1’s price tag is even lower than pundits expected, as predictions had it falling in line with Apple’s (NASDAQ: AAPL) iPhone 3G that AT&T now sells — with a two-year data plan — for $199.

That price for the iPhone also reflects the drops in pricing it’s undergone since the Apple smartphone’s 2007 debut, when 4GB models sold for $499 and an 8GB handset retailed for $599 — even with data plans. Now, the G1 is getting a similar, excited response — for arriving on the opposite end of the cost spectrum.

“It’s pretty aggressive,” industry analyst Jack Gold told InternetNews.com. “It reflects T-Mobile’s desire to make waves and capture new subscribers … As the network is not as good and not yet as fast as [AT&T’s], it really had to be aggressively priced.”

But it may be too early to tell whether the move will further stoke the price war ignited earlier this year.

One analyst believes the G1 device price reflects the fact that T-Mobile, and even Google (NASDAQ: GOOG), don’t match the brand power of Apple and AT&T.

“The price is lower than the iPhone, which I think makes a great deal of sense,” Carolina Milanesi, research director for mobile devices at Gartner, told InternetNews.com. “They need to make up somehow for the lower brand value and the less-sexy hardware. It is good to offer the choice on the data plan, too.”

Gold doesn’t see greater pricing shifts ahead for Apple and AT&T anytime soon.

“I don’t think that Apple has to match this on a price basis, as the iPhone has more features and is better positioned in the market. I think we are a long way from a price war,” he said.

Either way, increasingly advanced phones have shown themselves to be in hot demand among consumers.

Thanks to the influx of pricier, feature-rich smartphones, the average wireless handset — with average reflecting devices providing basic messaging and Web browsing options — now hovers about $101, the highest amount cited since the firm began studying wireless device costs five years ago, according to a May study from J.D. Power and Associates.

Users also are willing to spend an average of $9 more on new phones — an increase the research firm termed “substantial.”