The bulls are still a long way from turning this market around, but they have a couple of positives today, if they can build on them.

First, we had lower volume on today’s decline than we did on Friday, and much lower volume than the 6-7 billion share days we saw on the NYSE at January’s low. That’s how bear markets end, on lower volume. But we’re still lacking a significant reversal to suggest the bottom is in.

We also had tons of bearish sentiment among options traders today. If nothing else, that extreme accumulation of puts will add fuel to an eventual turn.

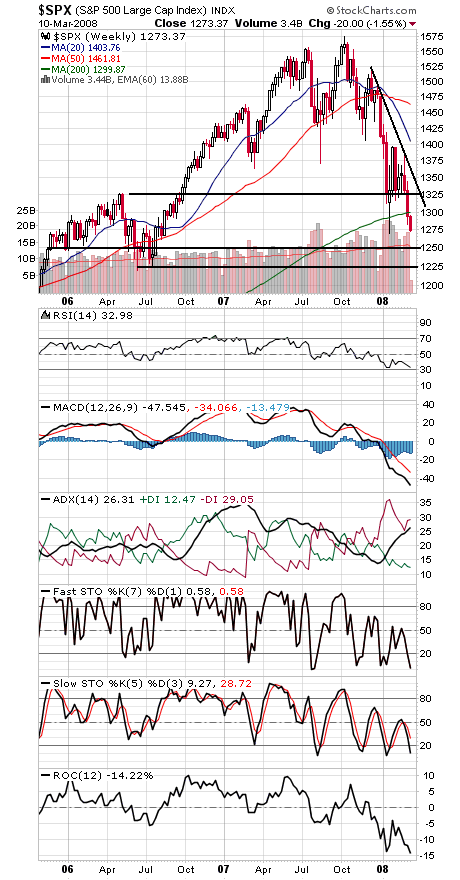

The S&P 500 (first chart below) is barely clinging to its January low of 1270. If that goes, 1250 and 1219-1225 come into play. 1300, 1313 and 1320-1325 are resistance.

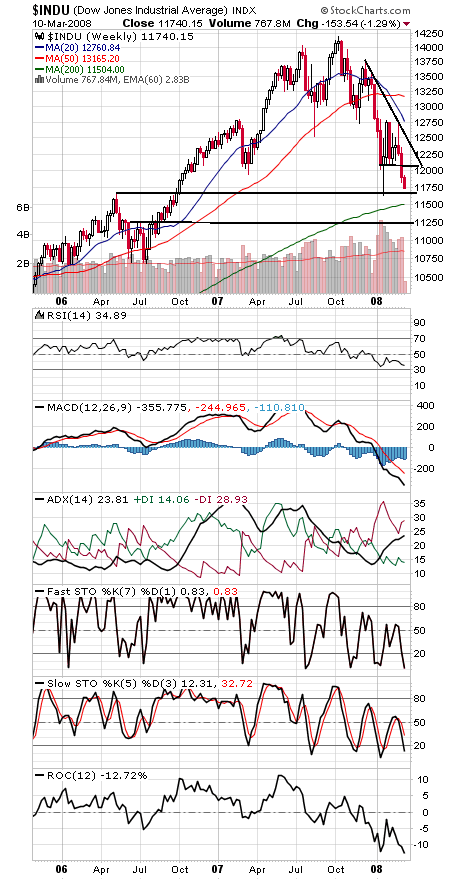

The Dow (second chart) has major support between here and 11,635, with 11,500 below that. 12,000 and 12,100 are the start of resistance.

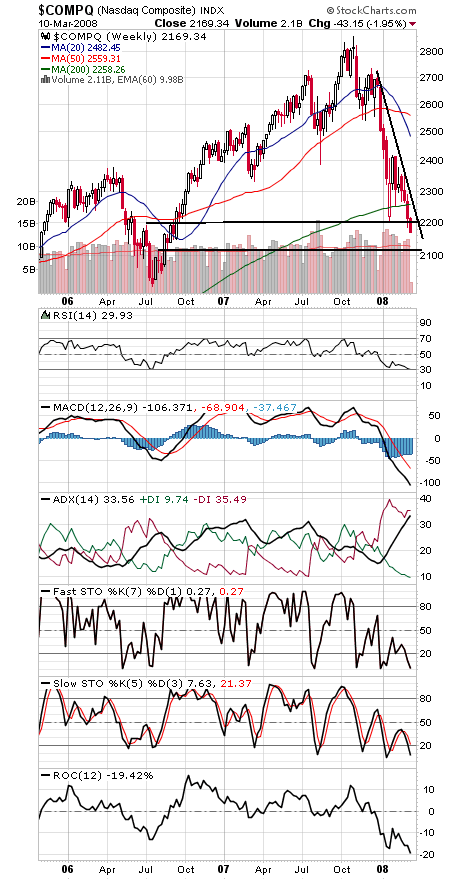

The Nasdaq (third chart) looks very oversold on a weekly chart, but doesn’t have much support until 2100-2120. 2260-2300 is major resistance.

Paul Shread is a Chartered Market Technician (CMT) and member of the Market Technicians Association.