We’ll add one more data point to the bullish evidence here: a nice move this week into S&P long positions by commercial traders.

We’ll see how that survives with expiry coming up, but that vote of confidence by the biggest traders is noteworthy.

Now all we need is for the market-friendly sentiment to show up in stock prices.

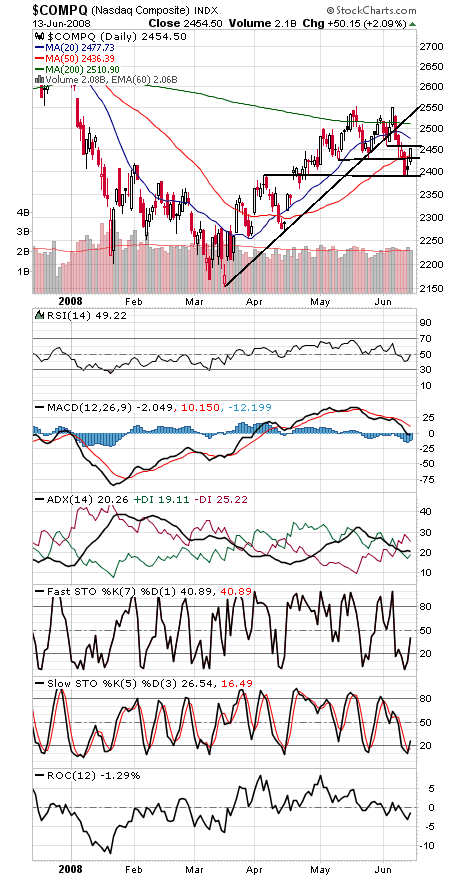

The Nasdaq (first chart below) made a nice start, clearing 2425-2434 resistance, which is now first support, with 2387-2392 below that. Next upside hurdles are 2470-2475 and 2500-2510.

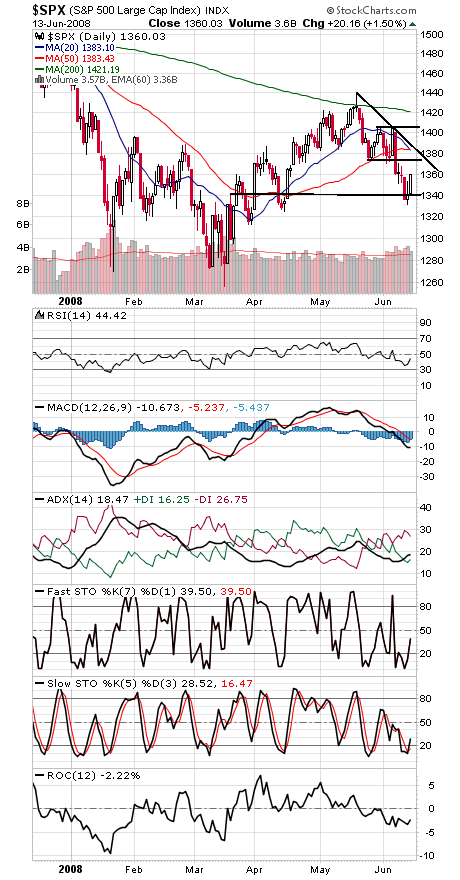

The S&P’s (second chart) faces difficult resistance at 1370-1374, 1383 and 1406, and support is 1340 and 1331.

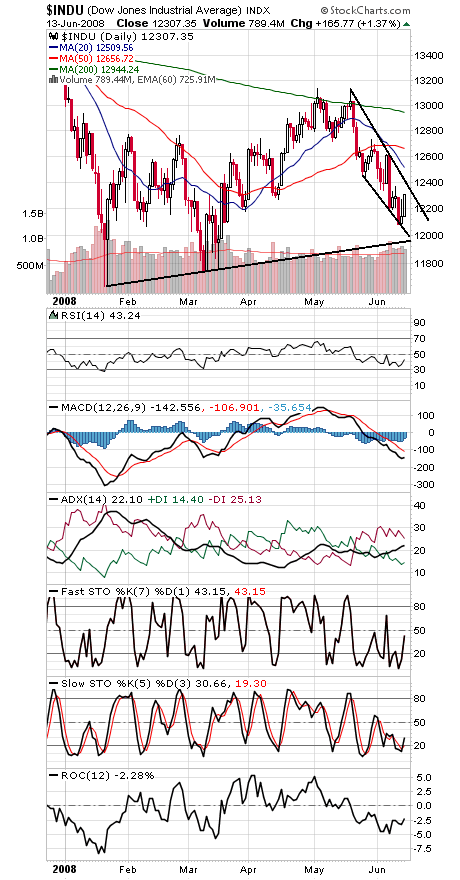

The Dow (third chart) faces resistance at 12,360-12,400, 12,500 and 12,600-12,743, and support is 12,076 and 11,960-12,000.

Paul Shread is a Chartered Market Technician (CMT) and member of the Market Technicians Association.