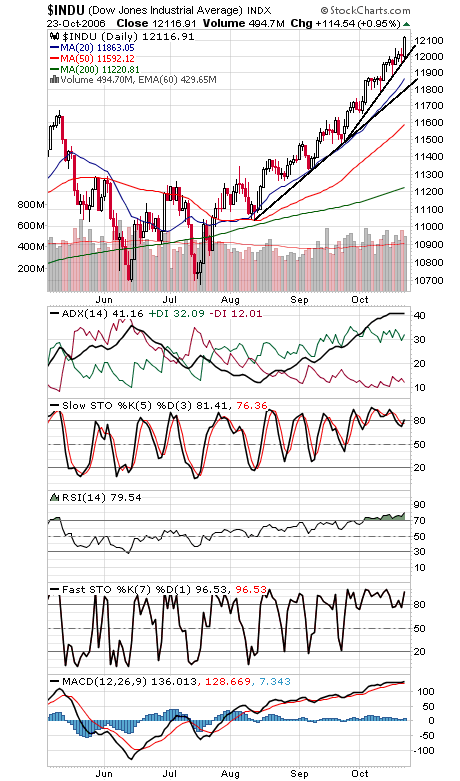

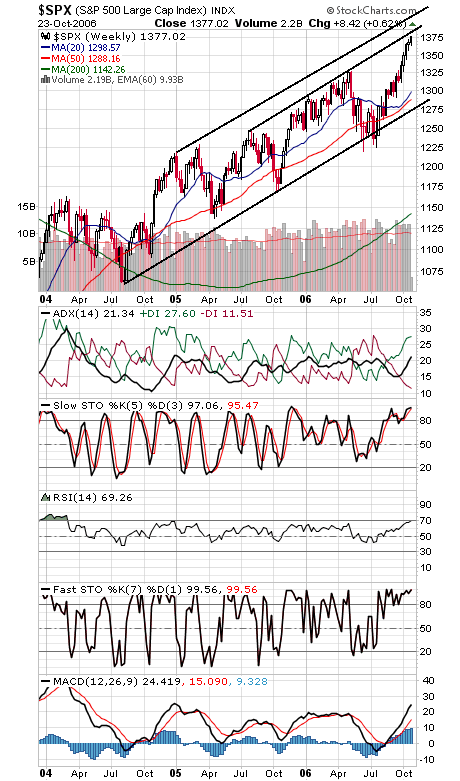

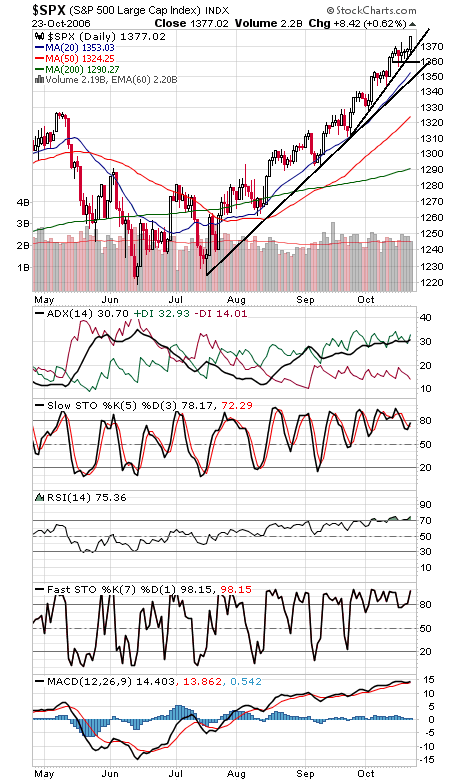

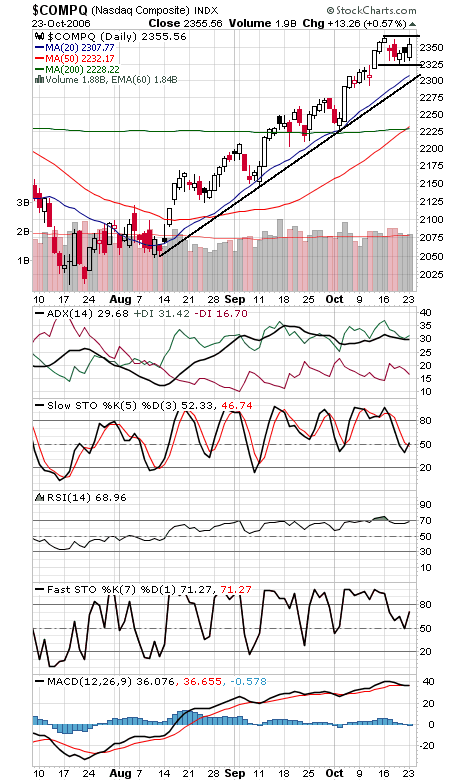

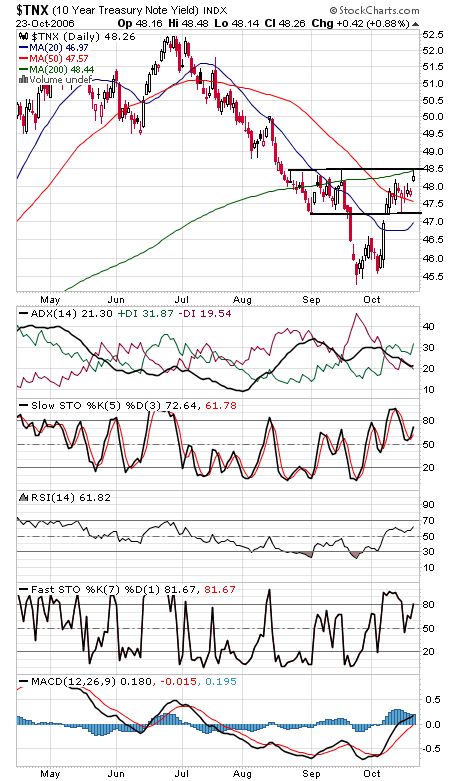

The Dow’s historic run-up continues — and has even been accelerating in the last month (see first chart below). This kind of strength in what has traditionally been the weakest months of the weakest year of the four-year cycle is virtually unprecedented; even the glorious 1950s saw corrections and consolidations at this time of year. Sentiment is no longer in the bulls’ camp, with the exception of the ISEE numbers, so the market carries with it some risk of a major top in the coming months. Next week begins the strongest six months of the year, however, and we have major trendlines for support on all the indexes, so we’ll know when the trend begins to change when those levels start to give. The Dow has major support at 12,000 and 11,820. The S&P (second and third charts) faces major resistance at 1382-1389, and support is 1370-1373, 1360, 1354 and 1350. The Nasdaq (fourth chart) faces resistance at 2364 and 2375, and support is 2323-2330 and 2305. Bond yields (fifth chart) tested a major resistance area today.