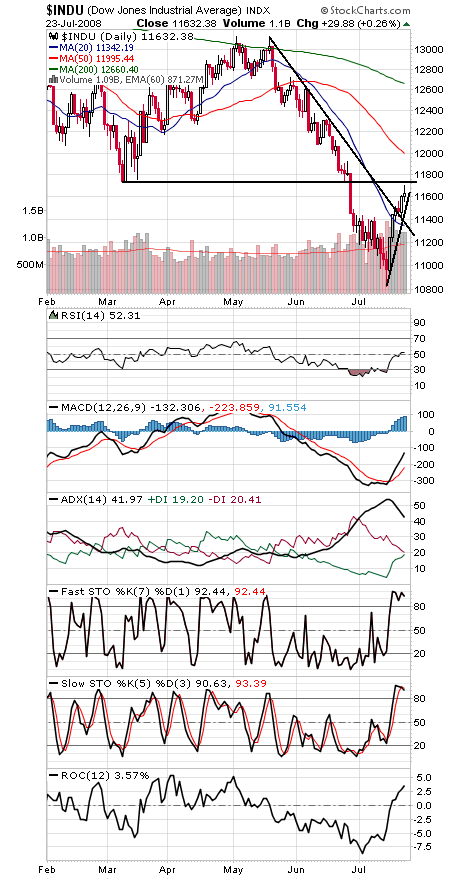

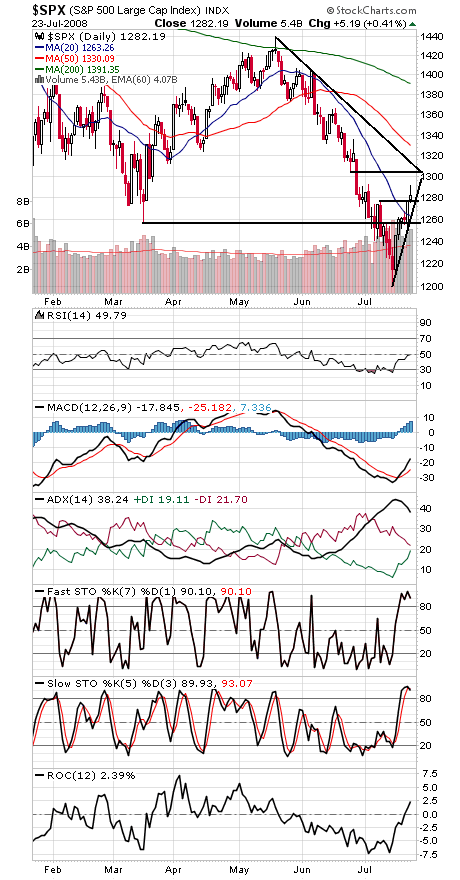

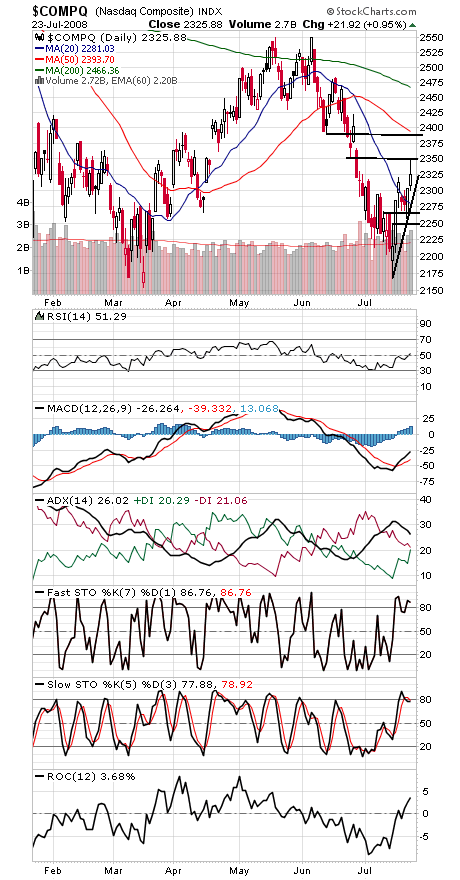

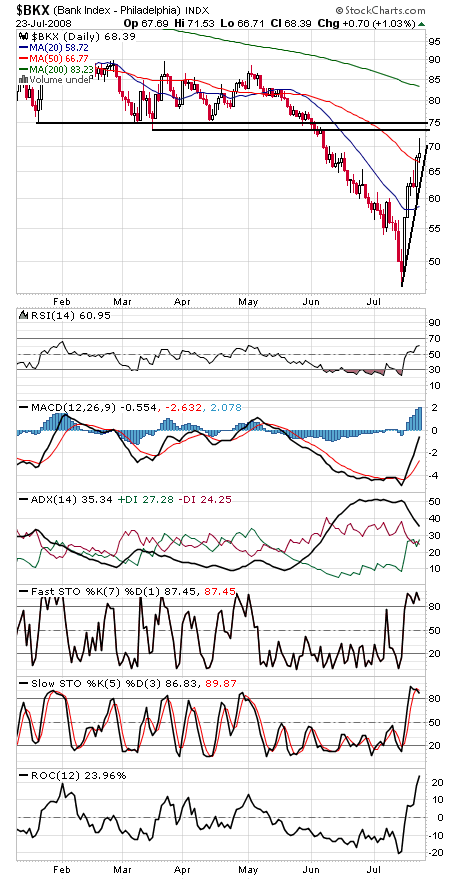

The rally ran out of steam today, not surprising given the number of indexes facing major overhead resistance here.

The Dow (first chart below) stopped just shy of 11,731-11,750, its March low and 2000 peak. If the index can clear that level, 12,000 looks possible. Support is 11,558, 11,500, 11,400 and 11,300.

The S&P (second chart) stalled at 1292 resistance today, with 1304 and 1310 waiting above that. Support is 1276-1277, 1267, 1262, 1257, 1249, 1240 and 1234.

The Nasdaq (third chart) stalled at 2350 resistance today, but 2388 looks like a more important level, the bottom of the first leg down last month. 2300, 2270-2280 and 2250 are support.

The bank index (fourth chart) is also nearing major resistance at 73.22-75. A nice recovery, but a good place for a pause.

Paul Shread is a Chartered Market Technician (CMT) and member of the Market Technicians Association.