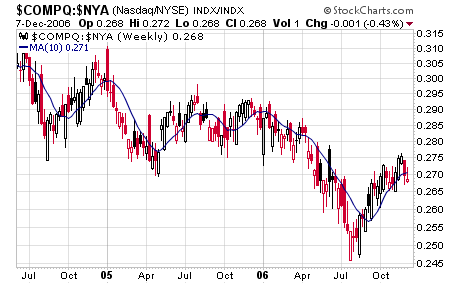

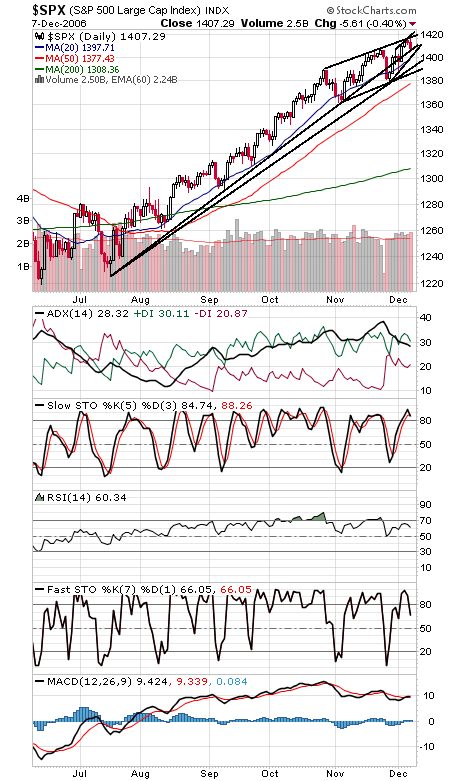

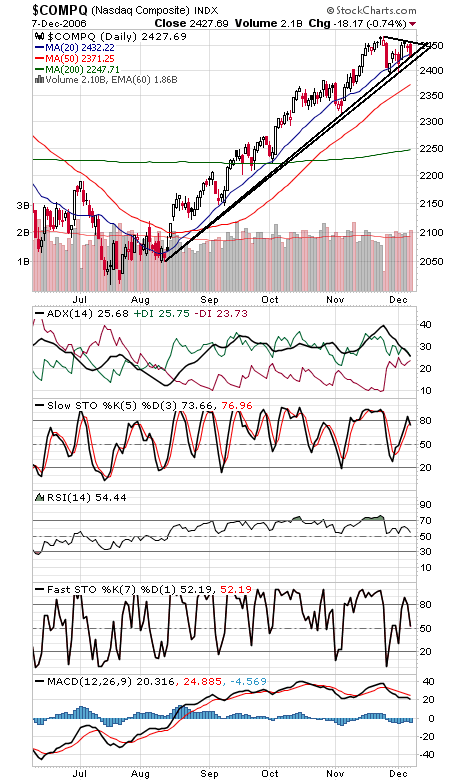

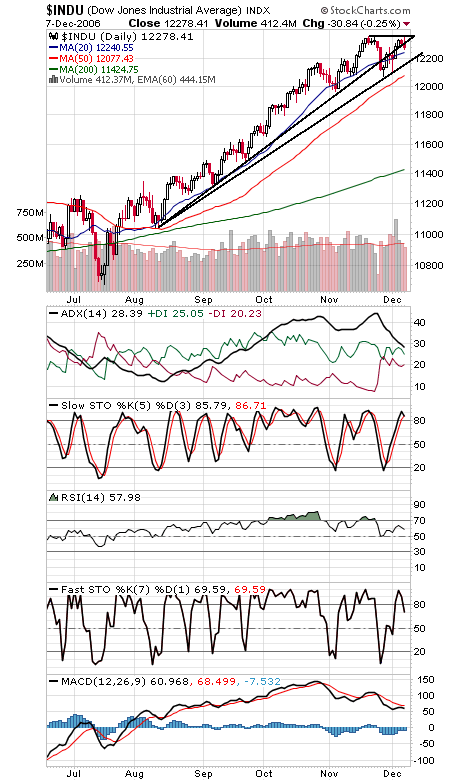

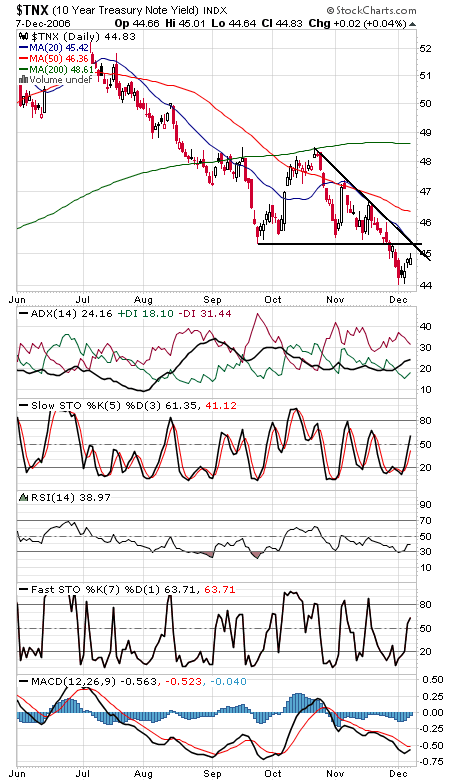

Outside days on all the indexes today, and Nasdaq underperformance (first chart below) has reached a critical level — a pretty uninspiring setup heading into tomorrow’s unemployment report. The market has historically been weak in early December, so we may be in for a repeat. Even if the Nasdaq registers a sell signal under Gerald Appel’s Nasdaq-NYSE relative strength indicator, however, it doesn’t mean the market will necessarily go down, but it does imply that investors are becoming more cautious and selective and that blue chips may be a safer bet for now. The S&P (second chart) remains the best looking index here, and the only one of the three main indexes to register a new high on this run. Support is 1403, 1400, 1392 and 1388, and 1419 is important resistance, with 1410 and 1414 up first. The Nasdaq (third chart) faces resistance at 2432, 2443, 2455 and 2468, and support is 2420 and 2400. The Dow (fourth chart) set a marginal new high before reversing. Resistance is 12,295-12,300, 12,325, 12,335 and 12,355-12,361, and support is 12,245, 12,200 and 12,170. Long bond yields (fifth chart) backed up again today. 4.53% is a critical level for bond bulls.